In a world where screens dominate our lives and the appeal of physical, printed materials hasn't diminished. No matter whether it's for educational uses in creative or artistic projects, or simply to add an individual touch to the area, How To Write A Tax Deductible Receipt are a great source. This article will dive into the world "How To Write A Tax Deductible Receipt," exploring the benefits of them, where they can be found, and how they can add value to various aspects of your lives.

Get Latest How To Write A Tax Deductible Receipt Below

How To Write A Tax Deductible Receipt

How To Write A Tax Deductible Receipt - How To Write A Tax Deductible Receipt, How To Write A Tax Donation Receipt, What Is A Tax Deductible Receipt, Example Of Tax Deductible Receipt, Can You Write Off Receipts On Taxes

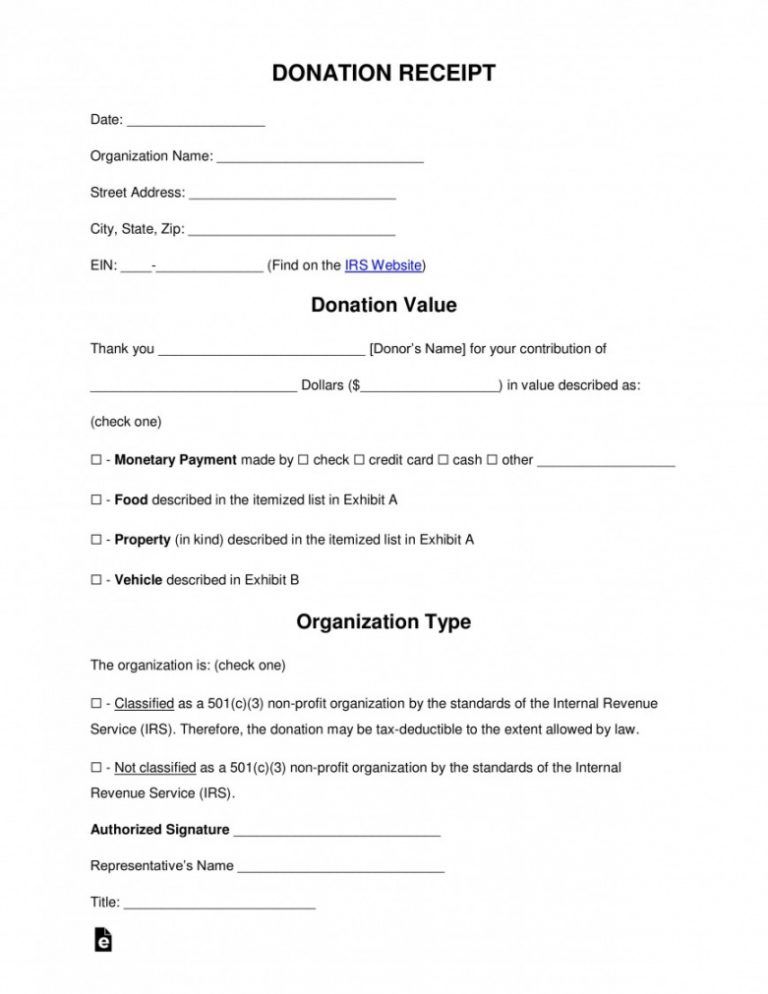

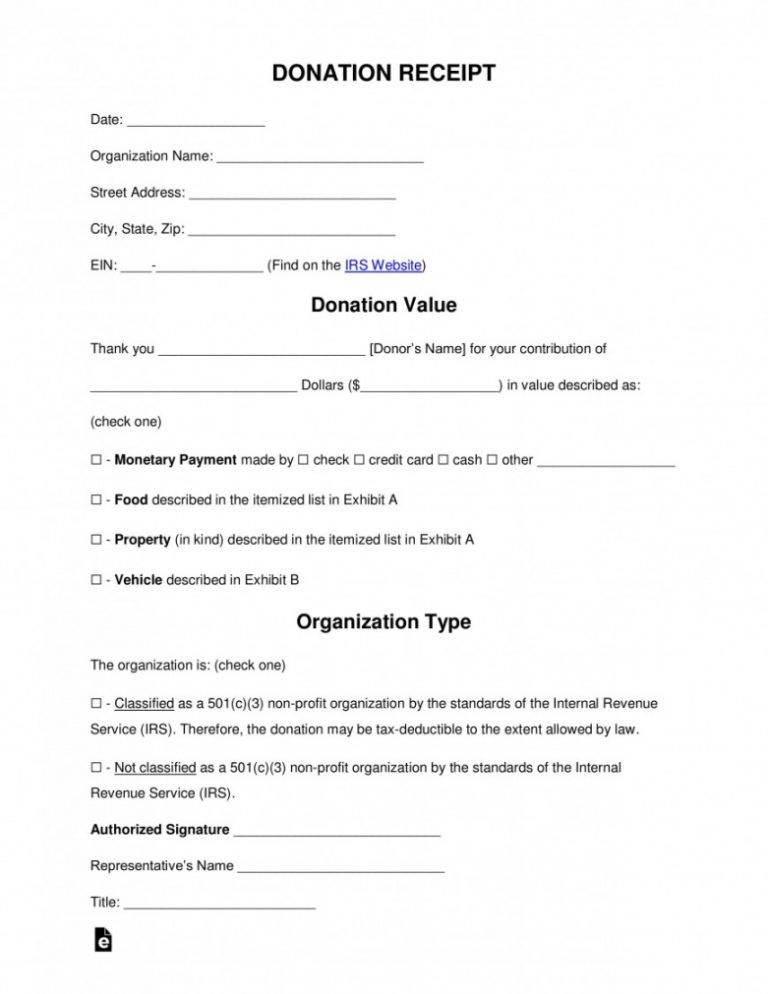

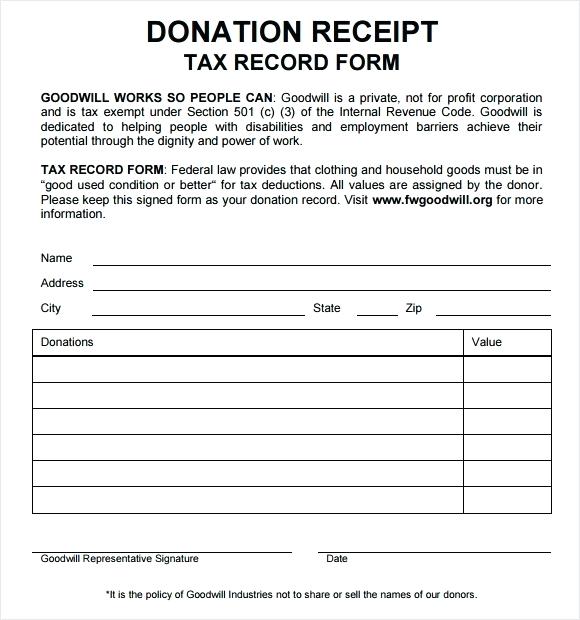

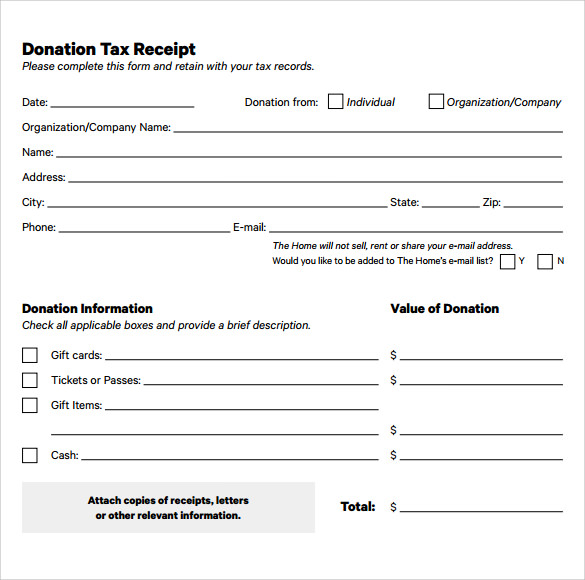

Charitable contributions Written acknowledgments The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information name of the organization amount of cash contribution description but not value of non cash contribution

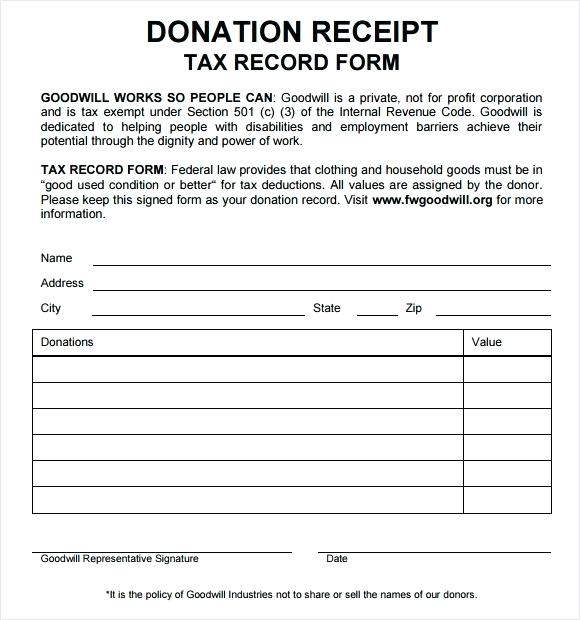

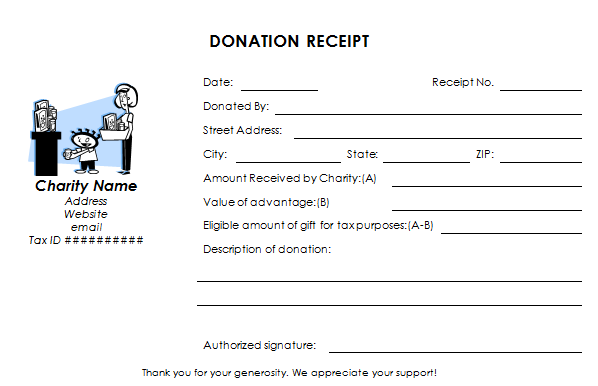

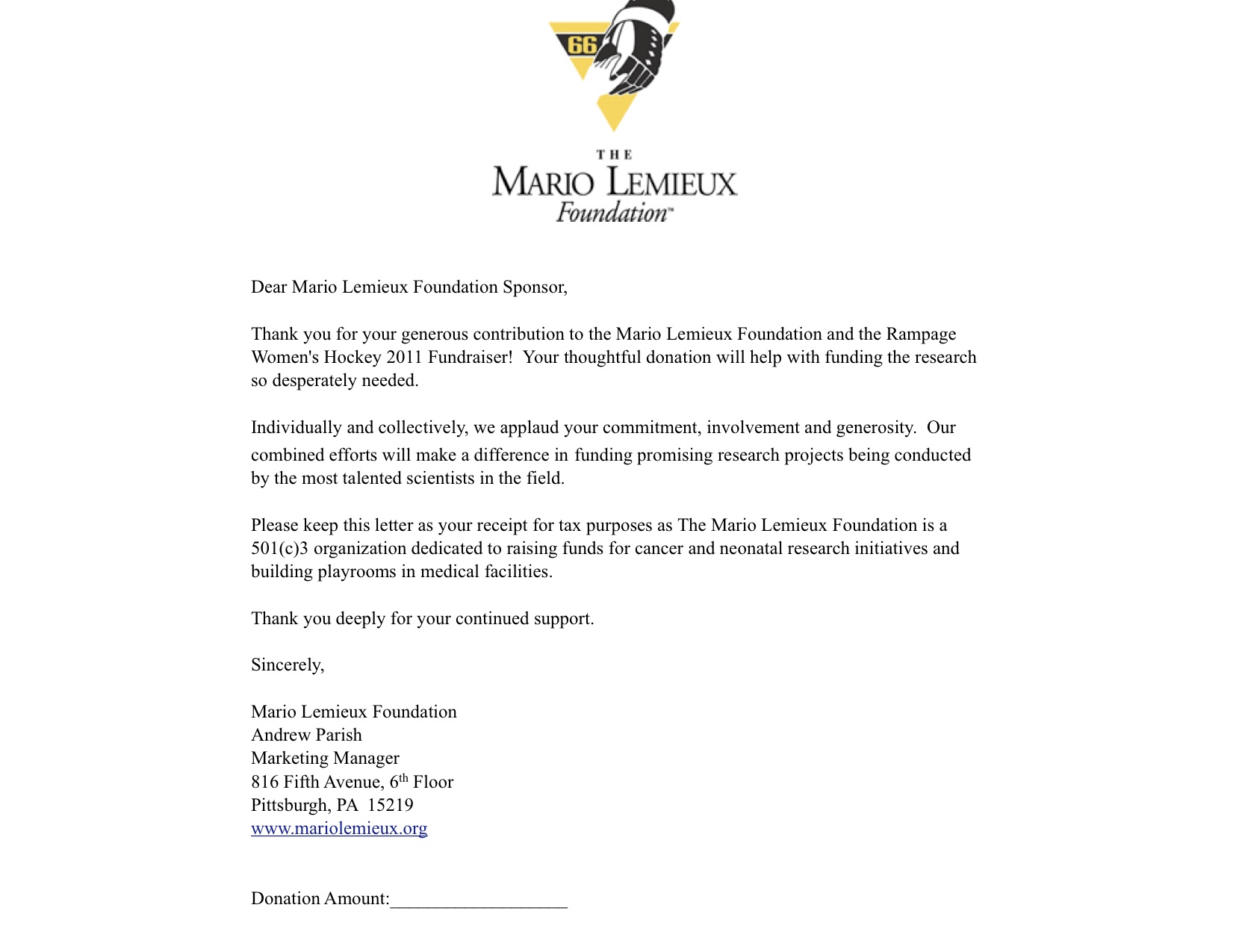

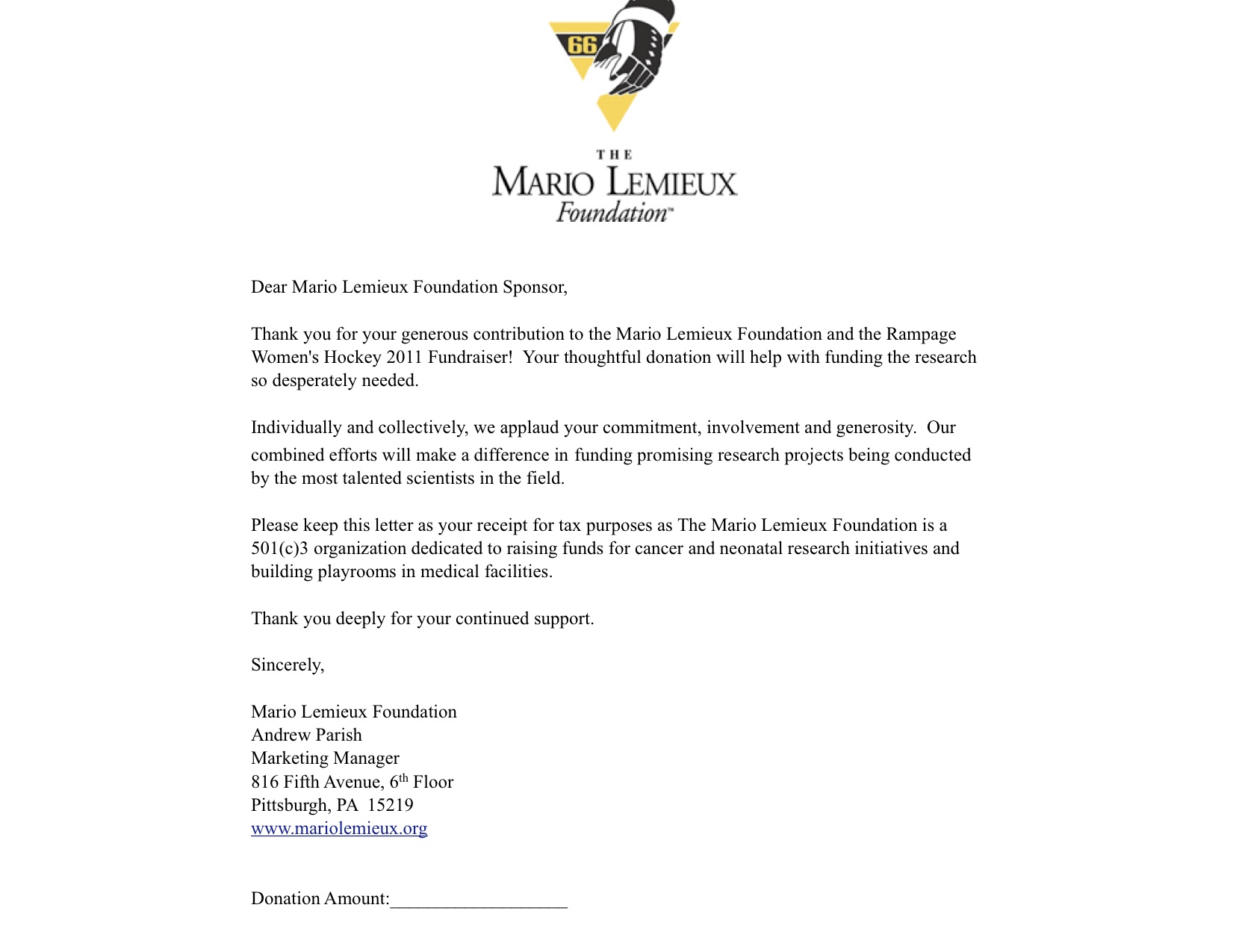

These donation receipts are written records that acknowledge a gift to an organization with a proper legal status Registered nonprofit organizations can issue both official donation tax receipts and more informal receipts By providing receipts you let your donors know that their donation was received

How To Write A Tax Deductible Receipt cover a large selection of printable and downloadable material that is available online at no cost. These resources come in many types, such as worksheets templates, coloring pages, and more. The benefit of How To Write A Tax Deductible Receipt lies in their versatility and accessibility.

More of How To Write A Tax Deductible Receipt

Tax Deductible Donation Receipt Template Charlotte Clergy Coalition

Tax Deductible Donation Receipt Template Charlotte Clergy Coalition

Your amazing donation of 250 has a tax deductible amount of 200 Below you will find a receipt for your records Don t worry we ll also send out a year end tax summary in time for you to file early next year

Last Updated January 21 2022 References Because charitable donations are tax deductible for the donor and reportable by the nonprofit organization a donation receipt must include specific information about the value of the donation and what the donor received in return

How To Write A Tax Deductible Receipt have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

The ability to customize: The Customization feature lets you tailor printables to fit your particular needs whether you're designing invitations and schedules, or even decorating your home.

-

Educational Value: Free educational printables cater to learners of all ages, which makes the perfect source for educators and parents.

-

It's easy: Quick access to various designs and templates saves time and effort.

Where to Find more How To Write A Tax Deductible Receipt

Luxury 501c3 Tax Deductible Donation Letter Donation Letter Template

Luxury 501c3 Tax Deductible Donation Letter Donation Letter Template

Follow a step by step process on how to create a 501 c 3 charity donation receipt which is tax compliant This comprehensive guide includes tips best practices and FAQs to ensure you re following IRS guidelines and maximizing

Donors giving more than 250 in a single contribution to a tax exempt nonprofit organization need a written acknowledgment from the organization to claim that deduction on their individual income tax return Does it have to be in a certain format Proper written acknowledgments can include many forms letters e mails or postcards

Since we've got your curiosity about How To Write A Tax Deductible Receipt We'll take a look around to see where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of How To Write A Tax Deductible Receipt for various purposes.

- Explore categories like decorations for the home, education and craft, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs with templates and designs for free.

- These blogs cover a wide range of interests, ranging from DIY projects to party planning.

Maximizing How To Write A Tax Deductible Receipt

Here are some new ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame stunning art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How To Write A Tax Deductible Receipt are an abundance of practical and imaginative resources that meet a variety of needs and preferences. Their accessibility and versatility make they a beneficial addition to your professional and personal life. Explore the endless world of How To Write A Tax Deductible Receipt now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes they are! You can download and print these resources at no cost.

-

Can I use the free printables to make commercial products?

- It depends on the specific rules of usage. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Some printables could have limitations on their use. Always read the terms and conditions provided by the designer.

-

How can I print How To Write A Tax Deductible Receipt?

- Print them at home using printing equipment or visit a print shop in your area for better quality prints.

-

What software do I need to open printables free of charge?

- The majority are printed in the format PDF. This can be opened with free programs like Adobe Reader.

How To Write A Tax Deductible Receipt Pocket Sense

Tax Deductible Donation Receipt

Check more sample of How To Write A Tax Deductible Receipt below

Tax Deductible Receipt Template Collection

Announcing Raisely s New Donation Receipting Features

Tax Deductible Donation Receipt Template

Tax Deductible Receipt Template Collection

Tax Deductible Donation Receipt Template Charlotte Clergy Coalition

Tax Deductible Donation Receipt Printable Addictionary

https:// donorbox.org /nonprofit-blog/donation-receipts

These donation receipts are written records that acknowledge a gift to an organization with a proper legal status Registered nonprofit organizations can issue both official donation tax receipts and more informal receipts By providing receipts you let your donors know that their donation was received

https:// eforms.com /receipt/donation/501c3

A 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more It s utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction

These donation receipts are written records that acknowledge a gift to an organization with a proper legal status Registered nonprofit organizations can issue both official donation tax receipts and more informal receipts By providing receipts you let your donors know that their donation was received

A 501 c 3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more It s utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction

Tax Deductible Receipt Template Collection

Announcing Raisely s New Donation Receipting Features

Tax Deductible Donation Receipt Template Charlotte Clergy Coalition

Tax Deductible Donation Receipt Printable Addictionary

Pin On Receipt Templates

How To Write A Tax Deductible Donation Letter

How To Write A Tax Deductible Donation Letter

Tax Deductible Donation Receipt Template Charlotte Clergy Coalition