In this age of electronic devices, where screens dominate our lives The appeal of tangible printed items hasn't gone away. For educational purposes, creative projects, or simply to add an individual touch to the space, Do You Need Receipts For Charitable Donations are now a vital source. We'll take a dive in the world of "Do You Need Receipts For Charitable Donations," exploring what they are, how they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Do You Need Receipts For Charitable Donations Below

Do You Need Receipts For Charitable Donations

Do You Need Receipts For Charitable Donations - Do You Need Receipts For Charitable Donations, Do You Need Receipts For Charitable Donations 2022, Do You Need Receipts For Donations, Do I Need Receipts For Cash Charitable Donations, Can I Claim Charitable Donations Without A Receipt

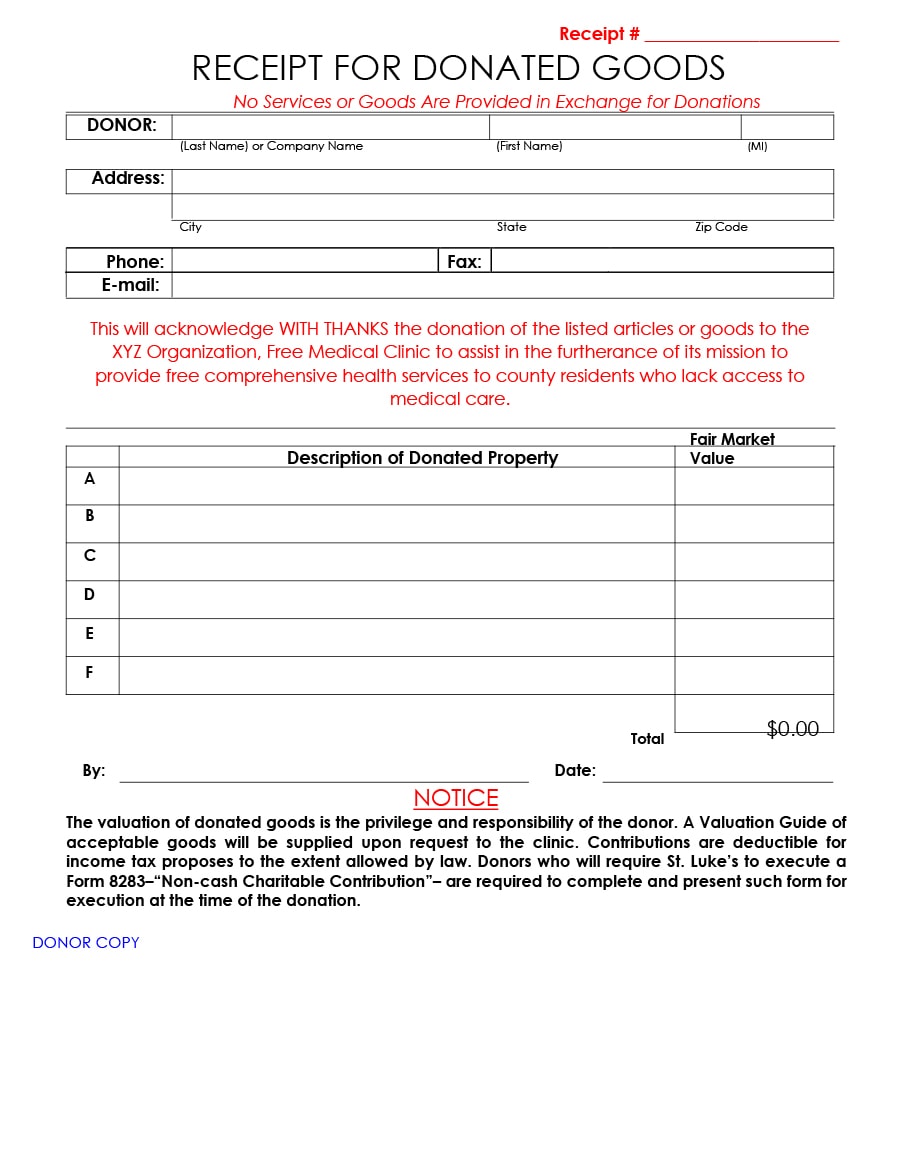

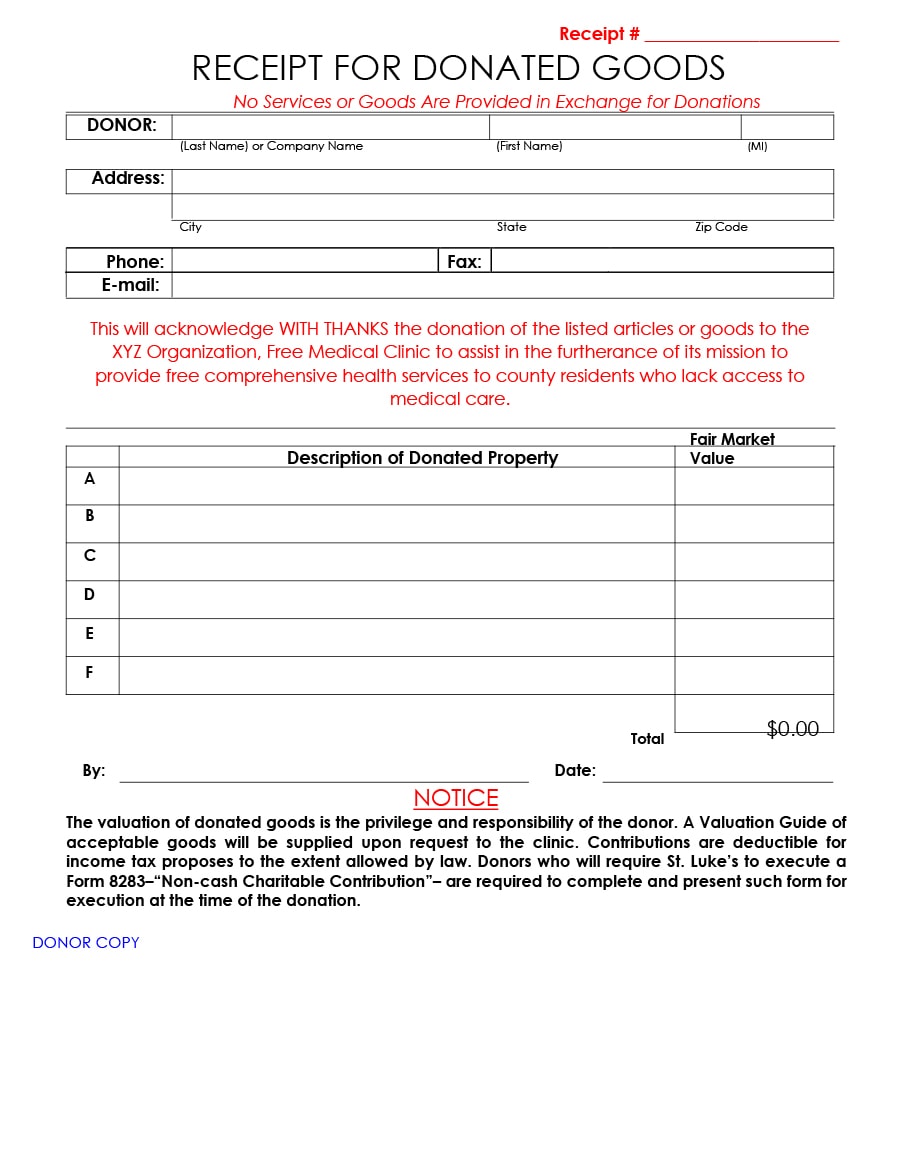

The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information name of the organization amount of cash contribution description but

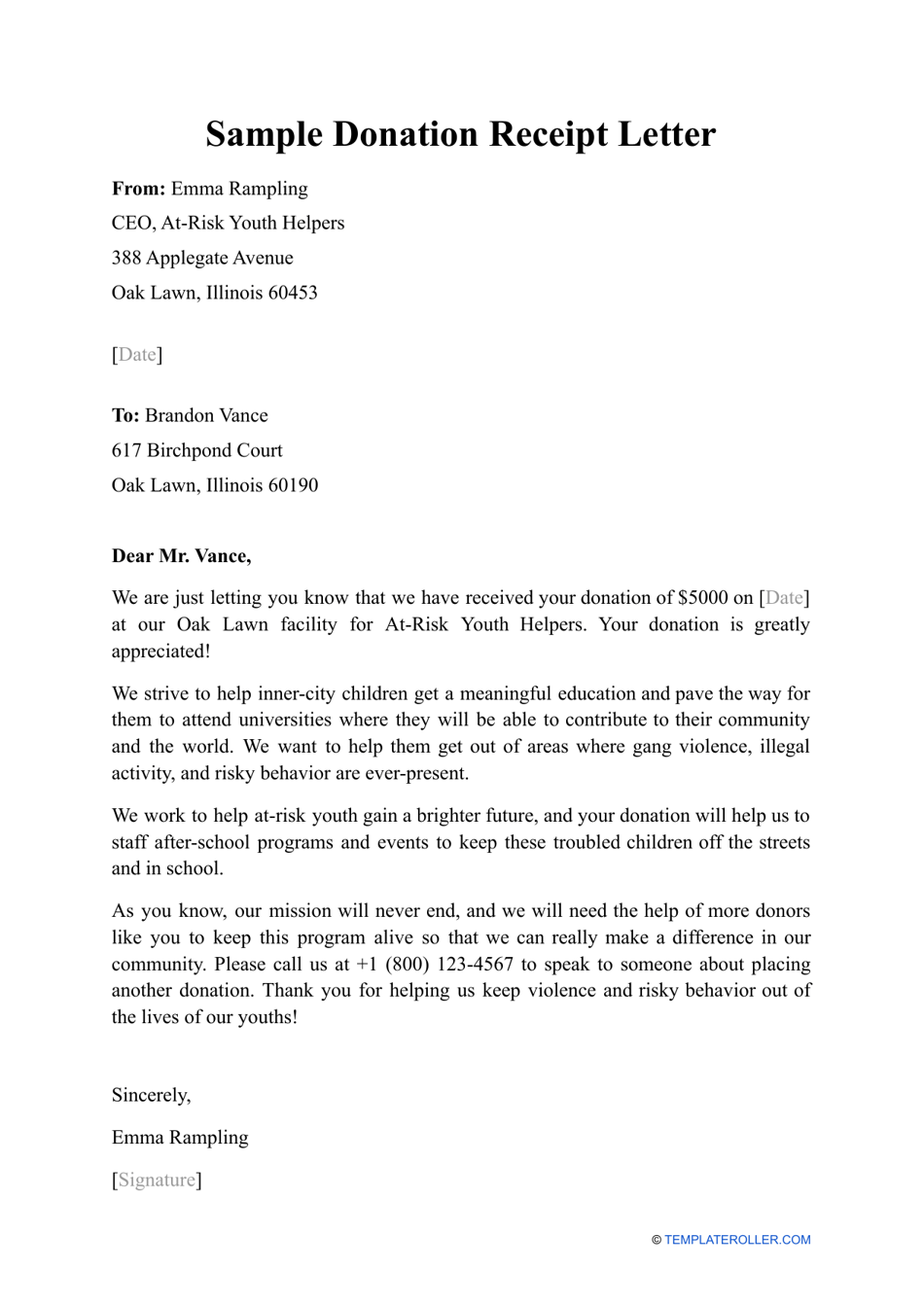

If a donation exceeds 250 the donor must obtain written acknowledgment of the donation before claiming a charitable contribution on their federal income tax return Plus a donation receipt is a chance to show donors that your organization is responsible transparent and grateful for all support

Do You Need Receipts For Charitable Donations cover a large assortment of printable, downloadable materials that are accessible online for free cost. These resources come in many types, such as worksheets coloring pages, templates and many more. One of the advantages of Do You Need Receipts For Charitable Donations is in their versatility and accessibility.

More of Do You Need Receipts For Charitable Donations

Why Do You Need Receipts For Corporate Credit Cards

Why Do You Need Receipts For Corporate Credit Cards

A donation receipt is a written acknowledgment from a nonprofit organization for any monetary or non monetary contributions made by a donor This donation receipt will act as official proof of the contribution and help donors claim a tax deduction

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction To claim a tax deductible donation you must itemize on your taxes

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Flexible: We can customize printing templates to your own specific requirements be it designing invitations and schedules, or decorating your home.

-

Educational Use: Printing educational materials for no cost provide for students of all ages. This makes them a vital resource for educators and parents.

-

Affordability: immediate access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Do You Need Receipts For Charitable Donations

Ye Olde Announcements Imgflip

Ye Olde Announcements Imgflip

Generally you can only deduct charitable contributions if you itemize deductions on Schedule A Form 1040 Itemized Deductions Gifts to individuals are not deductible Only qualified organizations are eligible to receive tax deductible contributions

Well written donation receipts meet IRS requirements and make donors feel good about their gift In this article you ll discover some do s and don ts to keep in mind as you create receipts that are IRS and donor approved plus a series of receipt templates that you can download for free

Since we've got your interest in Do You Need Receipts For Charitable Donations Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of reasons.

- Explore categories such as decorating your home, education, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Great for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates free of charge.

- The blogs are a vast selection of subjects, ranging from DIY projects to party planning.

Maximizing Do You Need Receipts For Charitable Donations

Here are some new ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use these printable worksheets free of charge to enhance your learning at home for the classroom.

3. Event Planning

- Make invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Do You Need Receipts For Charitable Donations are an abundance of fun and practical tools designed to meet a range of needs and passions. Their accessibility and flexibility make them a valuable addition to the professional and personal lives of both. Explore the vast collection of Do You Need Receipts For Charitable Donations right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can print and download these documents for free.

-

Can I download free templates for commercial use?

- It depends on the specific conditions of use. Always consult the author's guidelines before using any printables on commercial projects.

-

Are there any copyright issues with Do You Need Receipts For Charitable Donations?

- Some printables may come with restrictions in use. Make sure you read the terms and condition of use as provided by the author.

-

How do I print printables for free?

- Print them at home with either a printer or go to the local print shop for better quality prints.

-

What software do I need to open printables that are free?

- A majority of printed materials are with PDF formats, which is open with no cost software like Adobe Reader.

Charitable Donation Receipt Template Donation Letter Template

About Rent Receipts The Benefits Of Rent Receipts

Check more sample of Do You Need Receipts For Charitable Donations below

Do I Need Receipts For Everything In My Home If I Have A Total Loss

Nonprofit Donation Receipt Template In 2020 Donation Form Templates

Sample Donation Receipt Letter Download Printable PDF Templateroller

As A Business Owner Do I Need To Keep Receipts Atkinsons Chartered

40 Donation Receipt Templates Letters Goodwill Non Profit

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

https://donorbox.org/nonprofit-blog/donation-receipts

If a donation exceeds 250 the donor must obtain written acknowledgment of the donation before claiming a charitable contribution on their federal income tax return Plus a donation receipt is a chance to show donors that your organization is responsible transparent and grateful for all support

https://www.nonprofitexpert.com/nonprofit...

There is a legal answer on charitable receipt requirements provided by the IRS as well as a practical answer to this question in terms of building a relationship with your donors

If a donation exceeds 250 the donor must obtain written acknowledgment of the donation before claiming a charitable contribution on their federal income tax return Plus a donation receipt is a chance to show donors that your organization is responsible transparent and grateful for all support

There is a legal answer on charitable receipt requirements provided by the IRS as well as a practical answer to this question in terms of building a relationship with your donors

As A Business Owner Do I Need To Keep Receipts Atkinsons Chartered

Nonprofit Donation Receipt Template In 2020 Donation Form Templates

40 Donation Receipt Templates Letters Goodwill Non Profit

Charitable Donation Receipt Template FREE DOWNLOAD Aashe

Printable Free 10 Donation Receipt Examples Samples In Google Docs

The Sum Of All Crafts Do You Need A Receipt

The Sum Of All Crafts Do You Need A Receipt

Church Donation Letter For Tax Purposes Charlotte Clergy Coalition