In this age of technology, when screens dominate our lives but the value of tangible printed materials hasn't faded away. For educational purposes, creative projects, or simply adding an extra personal touch to your area, Are Student Loan Payments Tax Deductible are now a vital resource. With this guide, you'll take a dive deep into the realm of "Are Student Loan Payments Tax Deductible," exploring the benefits of them, where you can find them, and the ways that they can benefit different aspects of your life.

Get Latest Are Student Loan Payments Tax Deductible Below

Are Student Loan Payments Tax Deductible

Are Student Loan Payments Tax Deductible - Are Student Loan Payments Tax Deductible, Are Student Loan Payments Tax Deductible 2023, Are Student Loan Payments Tax Deductible Canada, Are Student Loan Payments Tax Deductible Reddit, Are Student Loan Payments Tax Deductible Uk, Are Student Loan Payments Tax Deductible 2022, Are Student Loan Payments Tax Deductible For Parents, Are Student Loan Repayments Tax Deductible, Are Student Loan Repayments Tax Deductible Uk, Are Student Loan Premiums Tax Deductible

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on qualified student loans from their taxable

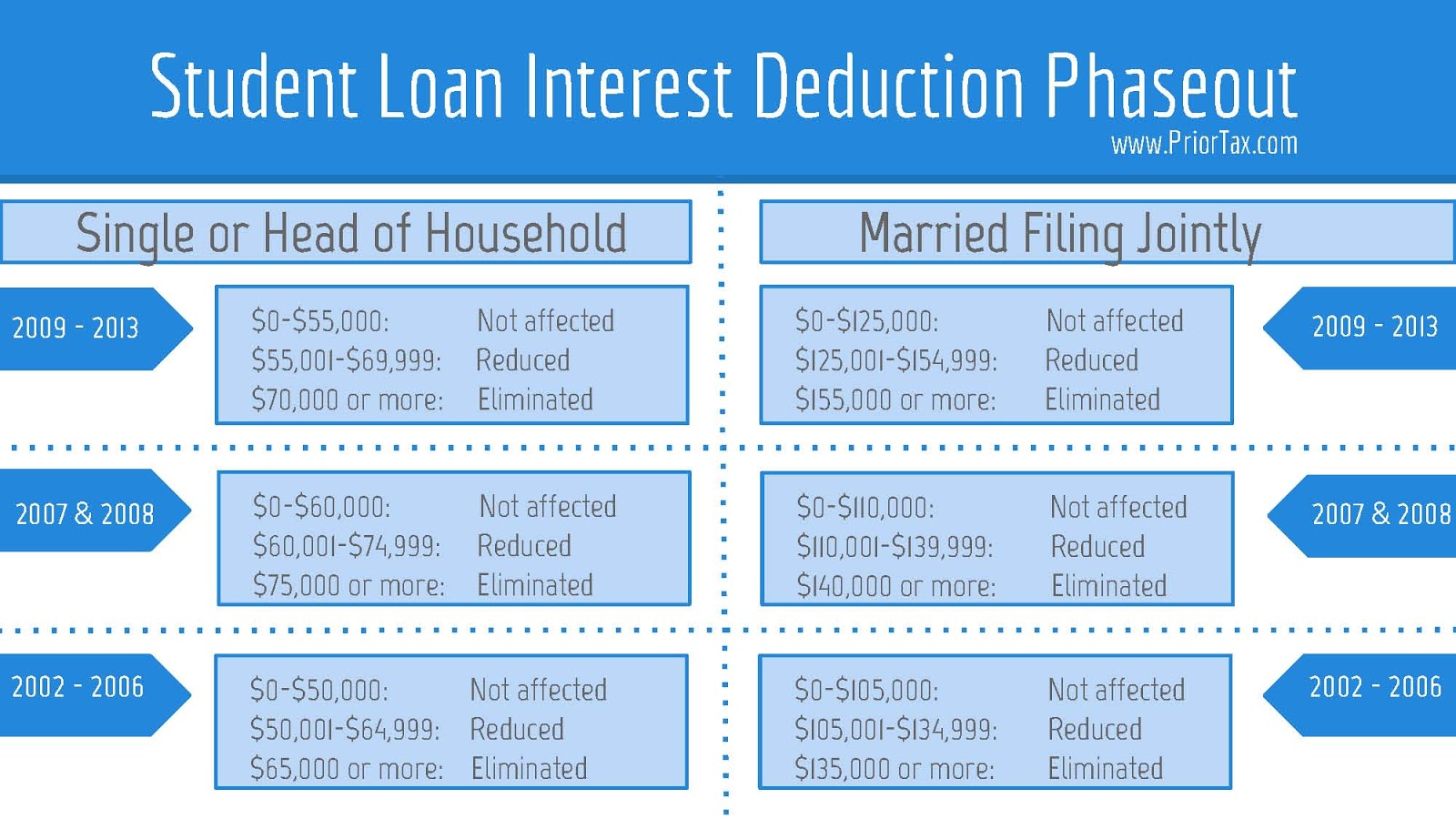

You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated

The Are Student Loan Payments Tax Deductible are a huge assortment of printable, downloadable materials that are accessible online for free cost. These resources come in various formats, such as worksheets, coloring pages, templates and much more. One of the advantages of Are Student Loan Payments Tax Deductible lies in their versatility as well as accessibility.

More of Are Student Loan Payments Tax Deductible

Income Tax Deductions Income Tax Deductions Student Loan Interest

Income Tax Deductions Income Tax Deductions Student Loan Interest

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in

A tax deduction is also available for the interest payments you make when you start repaying your qualified education loans Here s more about how student loans and educational expenses can affect

Are Student Loan Payments Tax Deductible have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or costly software.

-

Individualization You can tailor designs to suit your personal needs whether it's making invitations, organizing your schedule, or decorating your home.

-

Educational Impact: Printing educational materials for no cost offer a wide range of educational content for learners from all ages, making them a vital instrument for parents and teachers.

-

The convenience of Quick access to an array of designs and templates can save you time and energy.

Where to Find more Are Student Loan Payments Tax Deductible

Are Student Loan Payments Tax Deductible MoneyTips

Are Student Loan Payments Tax Deductible MoneyTips

Reporting the amount of student loan interest you paid in 2023 on your federal tax return may count as a deduction A deduction reduces the amount of your income that is subject

You may be able to deduct all or part of your student loan payments on your federal income tax getty Student Loan Interest Deduction The Student

Now that we've piqued your interest in Are Student Loan Payments Tax Deductible Let's take a look at where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with Are Student Loan Payments Tax Deductible for all objectives.

- Explore categories such as decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free with flashcards and other teaching tools.

- The perfect resource for parents, teachers or students in search of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- These blogs cover a broad array of topics, ranging ranging from DIY projects to party planning.

Maximizing Are Student Loan Payments Tax Deductible

Here are some fresh ways ensure you get the very most use of Are Student Loan Payments Tax Deductible:

1. Home Decor

- Print and frame beautiful artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities to enhance your learning at home also in the classes.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Are Student Loan Payments Tax Deductible are a treasure trove of useful and creative resources that cater to various needs and interest. Their accessibility and flexibility make them a fantastic addition to both professional and personal lives. Explore the vast array of Are Student Loan Payments Tax Deductible to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really absolutely free?

- Yes you can! You can print and download these free resources for no cost.

-

Does it allow me to use free printables for commercial use?

- It's dependent on the particular terms of use. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Are there any copyright concerns with Are Student Loan Payments Tax Deductible?

- Certain printables might have limitations regarding usage. Be sure to review the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- You can print them at home with a printer or visit a local print shop to purchase more high-quality prints.

-

What program must I use to open printables for free?

- The majority of PDF documents are provided in PDF format. These is open with no cost software like Adobe Reader.

Are Student Loan Payments Tax Deductible Student Loan Planner

Are Student Loan Payments Tax Deductible The Motley Fool

Check more sample of Are Student Loan Payments Tax Deductible below

Are Business Loan Payments Tax Deductible

Student Loans And Tax Credits What You Need To Know

Are My Student Loan Payments Tax Deductible WNY Asset Management

Is Your Business Loan Tax Deductible

Student Loan Payments In The COVID 19 Crisis Penobscot Financial Advisors

Are My Student Loan Payments Tax Deductible Woodmen Financial Resources

https://www.irs.gov/taxtopics/tc456

You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated

https://www.fool.com/.../student-loans-tax-deductible

Although you can t deduct the entire payment in many cases you can deduct student loan interest which can make a big dent in your tax liability Of course

You may deduct the lesser of 2 500 or the amount of interest you actually paid during the year The deduction is gradually reduced and eventually eliminated

Although you can t deduct the entire payment in many cases you can deduct student loan interest which can make a big dent in your tax liability Of course

Is Your Business Loan Tax Deductible

Student Loans And Tax Credits What You Need To Know

Student Loan Payments In The COVID 19 Crisis Penobscot Financial Advisors

Are My Student Loan Payments Tax Deductible Woodmen Financial Resources

Petition Make Student Loan Payments 100 Tax Deductible Change

Student Loans Payment Resume Key Dates You Must Consider Now That

Student Loans Payment Resume Key Dates You Must Consider Now That

Petition Make Student Loan Payments Tax Deductible To ALL Not Just